The world looks even bigger through those little minds, shiny eyes, and little hands. There is always so much to explore and even more to learn. However, toddler learning should be practiced in a safe space, where falling means getting up even stronger. But this doesn’t mean you can always put your child out there for the learning. There has to be some way for them to learn everything without being exposed to unnecessary danger.

Their little worlds are massive playgrounds of potential. And as caregivers, parents, cool older siblings, or digital-age nannies, we owe them more than just colorful distractions. What they need are tools. Intentional, magical tools that disguise learning as fun. Welcome to the realm of toddler games.

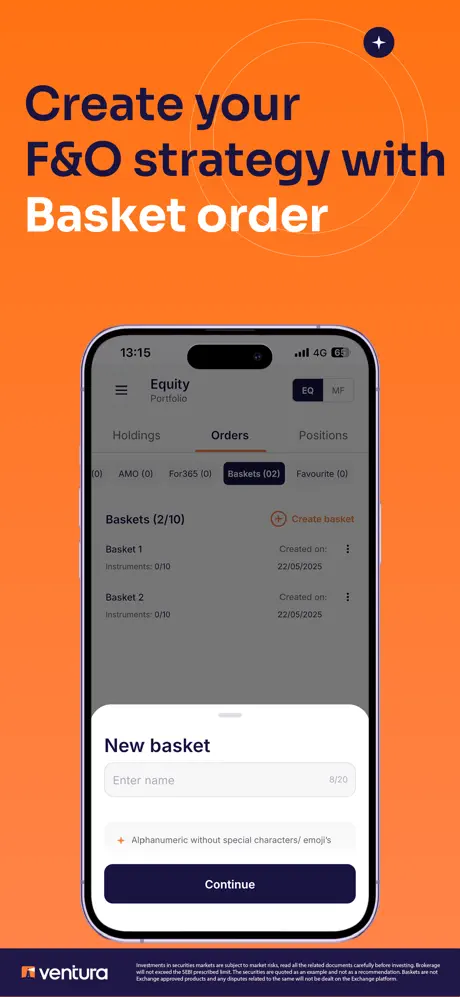

Online games for toddlers can be a great way for them to start learning slowly but steadily, without too much supervision and safely.

The age of two is a beautiful chaos. They talk a little, walk a lot, and negotiate like tiny lawyers. Their attention span is short but focused when engaged.

Preschool learning isn’t about making your toddler into a mini genius. It’s about giving them confidence in expression, navigating routines, and understanding the world a little better. Having a toddler learning app can help you prepare your child for preschool and social interaction. Not only that, it also gives them the opportunity to learn outside of those four walls.

Here are the best kinds of toddler games for 2 year olds that you can hand them guilt-free:

- Games with motor skills that they can learn through tapping, swiping, stacking, and dancing. These can include games where they can trace letters and draw patterns and require them to be on their feet and move around a little.

- Games with language foundations via rhymes, stories, and naming games. These can include games where they can interact with the characters while speaking, learn new words, and enhance their grammar.

- Games with problem-solving skills through puzzles and cause-effect games where they get to make choices and follow different routes in a game for different results.

- Games that enhance emotional intelligence by recognizing expressions and scenarios, where players can interact with game characters, talk to them, and listen to and understand instructions.

These games should be gently introduced to your kids, not as a form of learning with deadlines and punishment, but only with the pure joy of playing the games when you ensure that much learning automatically happens.

But, once in a while, sit down with them. Play together. Let them teach you how to pop bubbles or feed the monkey. Ask them what they’re doing. Laugh with them. Co-playing isn’t just bonding; it reinforces language, critical thinking, and emotional regulation.

So go ahead and curate their apps like you curate their meals: healthy, wholesome, and occasionally a treat.

Because in those moments of wide-eyed wonder, as your toddler giggles through a virtual zoo or sings a digital ABC, they’re not just playing. They’re growing—one joyful click at a time.

And you? You’re growing with them.

Happy learning. Happy playing.