Kiosk banking is a simplified model of financial service delivery that brings essential banking functions closer to people, especially in rural and semi-urban regions. Individuals can open a kiosk banking outlet to act as a bridge between banks and the public. This setup allows the delivery of services like deposits, withdrawals, and remittances without the need for a full-scale branch. As financial infrastructure grows beyond traditional models, open kiosk banking has become a sustainable approach to improve financial access.

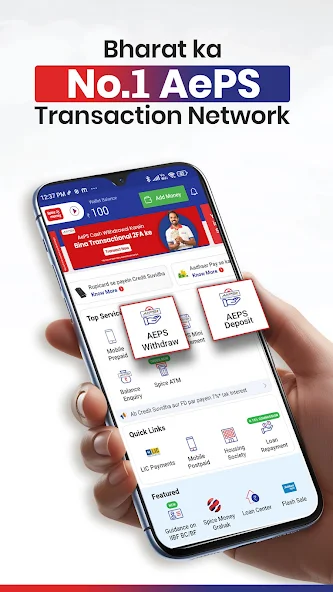

One of the essential tools that make kiosk banking effective is the AEPS service, which enables Aadhaar-based digital transactions. With biometric authentication and real-time processing, AEPS ensures secure banking operations for users with minimal risk of fraud. As more people rely on digital methods for their financial needs, the integration of AEPS into kiosk banking has reinforced trust and security, making it a preferred choice for both service providers and users.

What Is Kiosk Banking?

Kiosk banking is a service model that allows individuals or small businesses to offer basic banking facilities in partnership with banking institutions. These kiosks function as micro banking outlets that are digitally connected and provide access to savings, deposits, fund transfers, and withdrawal services. They serve as local points of contact, making banking convenient for people who might not have access to a branch.

Typically run by trained agents or small entrepreneurs, kiosk banking outlets operate with minimum infrastructure. They usually require a computer or mobile device, biometric scanner, printer, internet connectivity, and basic identification protocols. The entire system functions digitally, offering services securely and efficiently through simplified interfaces and AEPS integration.

Importance of AEPS Service in Kiosk Banking

What Is AEPS?

AEPS (Aadhaar Enabled Payment System) is a payment method that allows users to perform financial transactions using their Aadhaar number and biometric verification. AEPS supports several key functions including:

- Cash withdrawal

- Balance enquiry

- Mini statements

- Aadhaar to Aadhaar fund transfer

This system is particularly useful in rural areas where people may not carry debit cards or use mobile banking.

Why AEPS Matters

AEPS service provides a safe and reliable way for users to access funds using biometric verification, making it less prone to misuse or fraud. By using Aadhaar as a unique identifier, the transaction becomes highly secure. For kiosk operators, AEPS simplifies the verification process and builds confidence among customers, especially those unfamiliar with digital banking.

Benefits of Opening Kiosk Banking

Expands Financial Access

By opening a kiosk banking outlet, operators help increase banking coverage in unbanked areas. Many individuals in rural India still face difficulty accessing banks due to distance, lack of documentation, or digital illiteracy. Kiosks reduce this barrier and bring services directly to the local population.

Creates Employment and Income

For individuals looking to start a small-scale venture, kiosk banking offers an opportunity to earn a stable income by providing financial services to their community. With minimal investment and setup, the kiosk model supports self-employment and economic independence.

Promotes Digital Banking Practices

As people become more accustomed to digital interfaces through kiosks, they gradually adopt other digital banking solutions. This exposure creates awareness about secure digital transactions, online saving, and the importance of financial literacy.

Secure Transactions with AEPS

Security is a major concern when dealing with cash and digital transactions. AEPS plays a crucial role here, ensuring each transaction is authenticated through biometric verification. This minimizes risks such as identity theft, unauthorized access, or data breach, and gives both operators and customers confidence in the process.

Steps to Open Kiosk Banking

Opening a kiosk banking center involves a few steps that need to be followed carefully:

1. Eligibility Check

Individuals should meet basic eligibility criteria such as:

- Minimum age of 18

- Basic knowledge of digital tools

- A clean financial background

- Valid identification and address proof

2. Setup and Infrastructure

The setup generally requires:

- A laptop or desktop

- Fingerprint scanner for AEPS

- Printer for receipts

- Internet connection

- Secure location for customer interaction

3. Registration and Training

After meeting the basic setup requirements, the next step is to register with the bank or financial partner offering the kiosk model. Once registered, the operator undergoes training on transaction processes, compliance, AEPS functionality, and customer handling.

4. Starting the Service

Once approved and trained, the kiosk becomes operational. The operator can start offering services like account opening, deposits, withdrawals, AEPS transactions, and bill payments. Regular audits and digital reporting help maintain security and service quality.

Ensuring Secure Transactions at Kiosk Outlets

Transaction security is essential for building trust and credibility among users. Here are key measures kiosk operators can take:

Use of Biometric Authentication

Biometric-based AEPS transactions prevent unauthorized access. The requirement for a fingerprint or iris scan adds a second layer of authentication beyond just numbers or passwords.

Daily Reconciliation

Kiosk operators must verify all transactions at the end of the day and keep digital and printed records to ensure no discrepancies arise. Any issues should be reported immediately to avoid financial risks.

Customer Education

Educating users on how transactions are processed, how AEPS works, and why biometric security matters can significantly reduce misinformation and misuse.

Secure Infrastructure

Operating systems must be updated regularly, internet connections should be private, and access to the digital kiosk should be password-protected. A secure environment ensures safe handling of user data and transaction records.

Conclusion

Opening a kiosk banking outlet is a practical step toward promoting inclusive and secure financial services. These kiosks not only empower individuals to access essential banking facilities in their locality but also strengthen the digital financial ecosystem. With the support of AEPS service, secure and verified transactions become possible even in the most remote regions.

If you are planning to open kiosk banking, understanding the operational process, setting up the right infrastructure, and ensuring transaction security are crucial. AEPS technology makes the system more reliable, and with proper training and oversight, kiosk operators can successfully support secure financial inclusion across the country.