With the rapid pace of today’s digital age, borrowing money has become a lot easier and more convenient. Whether it is for an emergency, home improvement, or to consolidate debt, you no longer have to stand in long lines or undergo lengthy paperwork. Thanks to the internet platforms, you can now apply for loan online within minutes. What if your credit score is poor? Worry not — there are still good solutions that help you receive the financial assistance that you need.

Why Applying for a Loan Online Makes Sense

Internet-based lending platforms have changed the way we borrow money. They are convenient, speedy, and lightly documented. Just with a phone or computer, you can seek personal loan whenever you want, sitting at home. They often have instant checks for eligibility, clear interest charges, and flexibility in repayment terms.

In addition, web loan applications merely take a couple of hours to be approved. This is specifically useful during dire financial emergencies such as medical bills, travel necessities, or cash flow problems.

The Role of Loan Apps in Quick Borrowing

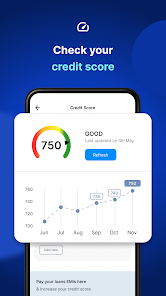

Loan apps are revolutionizers in the domain of personal finance. These simple-to-use mobile apps are designed for quick processing and are particularly favored by salaried individuals and freelancers. A trustworthy loan app will enable you to upload your documents, verify your eligibility, and get money transferred to your bank account — within a few hours or even minutes.

When choosing a loan app, ensure it is secure, has good user reviews, and is registered with regulatory bodies. Some apps even offer personalized EMI plans and early repayment features, making them an ideal choice for responsible borrowers.

Getting Approved with a Low Credit Score

One of the largest obstacles borrowers encounter is a low credit score. Conventional banks will frequently deny credit to those with poor credit. Yet a number of online lenders are experts at providing the best loan for low credit score. These loans may have a slightly higher interest rate, but they are an important crutch when other sources of finance are out of reach.

To be more likely to be accepted:

- Select lenders that deal specifically with low-credit borrowers.

- Select secured loans (such as against fixed deposits or gold) if possible.

- Provide additional documents like proof of stable income.

- Do not apply for multiple loans simultaneously, as this will again negatively impact your credit score.

- Timely repayment of these loans will actually improve your credit score in the long run and facilitate easier and cheaper borrowing in the future.

Final Thoughts:

Whether you’re hit by a financial crisis or have a big expenditure in mind, understanding how to apply for personal loan is the smart way to turn the tables around. With a reliable loan app, even low credit scorers can look at lending options. The ability to apply for loans online brings an entire world of convenience and flexibility that banking facilities usually lack.

Remember to lend responsibly always. Compare and read the small print before deciding to borrow. Make sure your repayment capability matches the terms offered. Digital lending is here to stay — and with the right strategy, it can benefit you.